> An updated edition of this blog is available <<

The Direct Primary Care (DPC) memberhsip model absolves the need for insurance for non-emergency care, from physician consultations to ancillary services, such as laboratory and radiology services. All costs are transparent, affordable and predictable with the all-inclusive monthly membership. Various private surgical groups are now publishing all-inclusive non-emergency surgical procedures so insurance is even not needed for them.

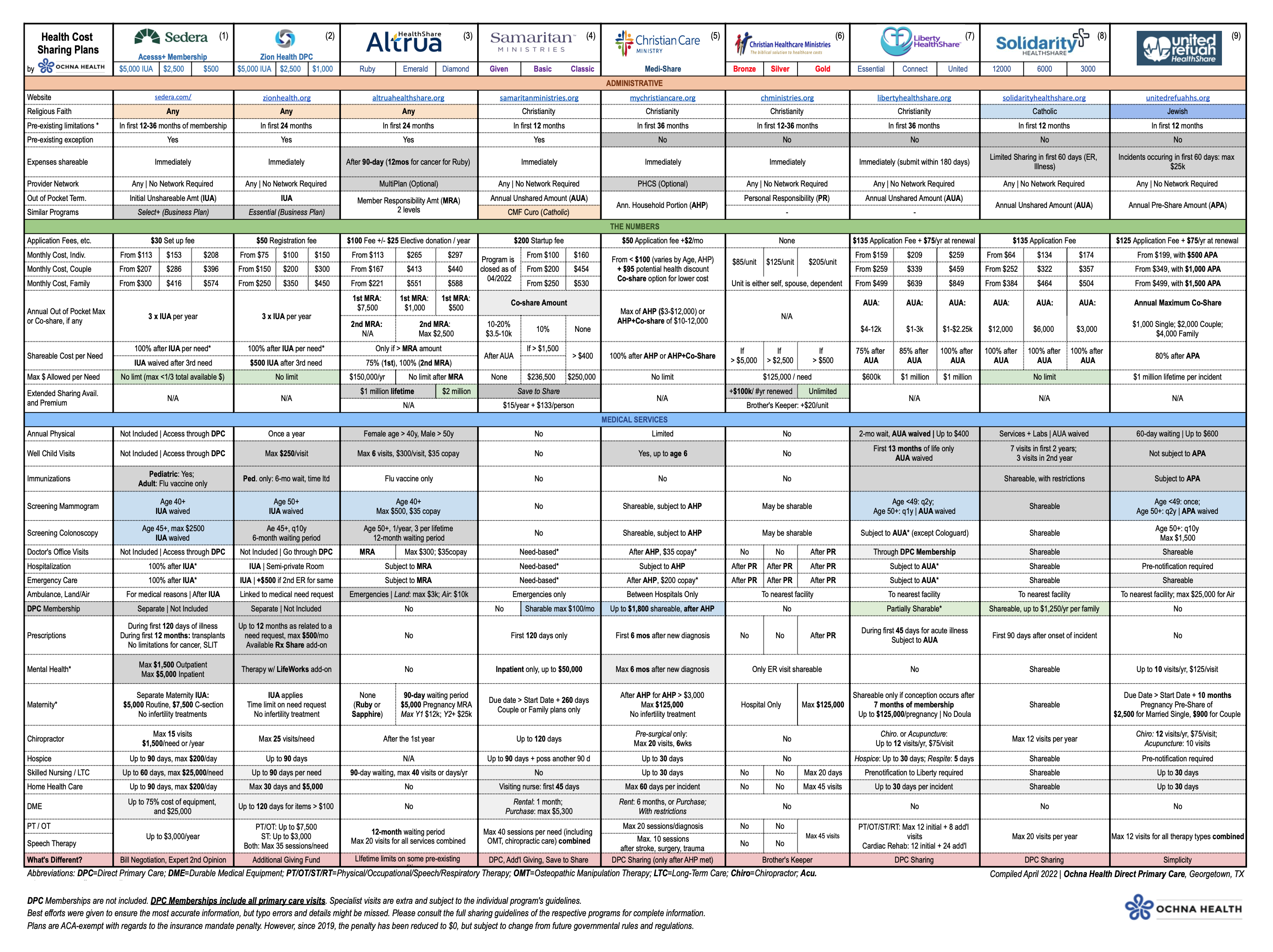

The DPC model allows members to purchase insurance or other plans purely for catastrophic needs at a much lower cost by forgoing inclusion of routine care in their plans. Unless you have chronic medical conditions that truly require the care of a specialist physician and expensive medications (about 15% of you), a health cost sharing plan may be just what you need. These programs dovetail with a DPC membership perfectly, at a combined cost that is usually half of traditional insurance offerings.

Please refer to Sedera Health’s website for full information.

The following applies to Sedera Health Access+ Program only. Other programs may differ.

- Pre-existing conditions: Eligible for sharing at up to $15,000 in the 2nd year, $30,000 in the 3rd year of membership, then NO restrictions afterwards, subject to Guidelines

- Tobacco: Additional $75/mo per household + Limits on benefits for tobacco users age 50+: $25,000 for Cancer, Heart conditions, Stroke, Oral/Esophageal/Gastric/Duodenal/Lung diseases (until 12-month tobacco free)

- Maternity IUA of $5,000 for normal or $7,500 C-section deliveries applies regardless of routine IUA plan chosen (IUA reduced by 50% for using a birthing center) for delivery date beyond first 12 months of membership

- Mental Health: Pscyhological services shareable up to $750/need, and $750/year

Please refer to Zion Health’s website for full information.

The following applies only to the Zion Health DPC Program. Other programs may differ.

- Pre-existing conditions: May be shareable under Additional Giving Fund in 1st year, up to $25,000 in 2nd year, $50,000 in 3rd year, and $125,000 in 4th year onward

- Exemptions: Diabetes (types 1 and 2), High blood pressure, High cholesterol, and Fully cured conditions NOT requiring treatments in the prior 24 months

- Tobacco: Additional $50/mo per household + Limits on benefits for tobacco users age 50+: $50,000 for Cancer, Heart conditions, Stroke, COPD

- Sharing for colonoscopies and other preventive services requires 12 months of Direct Membership or 6 months if having Connect Add-on.

- Maternity: 1xIUA may be waived for home births | Pregnancy 60 days prior to start of membership not shareable | Premature birth shareable

- Death benefits require 2 years of uninterrupted membership: $10,000 primary member or spouse, $2,500 dependent child

- Connected add-on: colonoscopies, mammograms and youth (ages 0-16) immunizations (IUA waived)

Please refer to Altrua Healthshare’s website for full information.

- Doctor’s Office Visits: Maximum $300/visit can be counted towards 1st MRA, then 2nd MRA

- Maternity: Only for Emerald or Diamond Membership plans, with a 90-day waiting period, $5,000 Maternity MRA, with maximum of $12,000 in the first year, and $25,000 from the 2nd year onward.

Max $4,000 normal delivery, $6,000 non-elective C-section, and after 10 months of a Couple Membership - Colonoscopy: Not shareable in the first year; Maximum 1 per year, 3 per lifetime, unless having genetic diseases

- Lifetime and 5-year restrictions on several pre-existing conditions

Please refer to Samaritan Ministries’ website for full information.

- Pre-existing conditions: shareable after 5 years of no symptoms or treatment, or 3 years for genetic defects, hereditary diseases, cases of related cancers, back programs, implants, and heart conditions

Exemptions from Pre-existing conditions limitations: Diabetes, Hypertension, Cholesterol. Pre-existing is considered any conditions that requires medical attention within the prior 12 months. - $50 Additional monthly for each family member for families over five (5) people

- Classic/Basic Programs: DPC Memberships are eligible for sharing at up to $100 for the month in which a physician is consulted, makes a referral, or charges for services related to a shareable need.

- Sharing after IUA is 90% for Samaritan Basic, 100% for Samaritan Classic.

- Maternity: Due date must be 260 days or more from membership start date; Individual Membership not eligible;

Basic/Classic: $1,500 + 10% Co-share + Sharing limit of $5,000, then no sharing until cost exceeds $13,500, and then max $236,500; Given: per plan limitations.

Home Birth + VBAC: $1,500 IUA waived

Please refer to Christian Care Ministry’s website for full information.

- Monthly Amount depends on age, family size, and selection of AHP amount. Opting into Co-Share option allows for lower monthly premium.

- Cost might be higher when not using PHCS, such as a co-liability of 20% at non-PPO hospitals.

- The $35 and $200 co-payments are required even after the member has met the AHP amount.

- Pre-existing conditions: shareable only after 36 months of membership, up to $100,000/year if no symptoms in the last 36 months, or $500,000/year if in the last 60 months.

Exceptions: High blood pressure, Cholesterolterol - DME: No sharing of motorized locomotion equipment (such as motorized wheelchairs, scooters), exercise equipment, or home modifications

- Maternity: Conception has to be after joining, with maximum amount shared at $125,000.

- Mental health: Short-term counseling available through telemental health service

Please refer to Christian Healthcare Ministries’ website for full information.

- Pre-existing conditions: Conditions requiring no treatment for 1 year, except for cancer (when it is 5 years)

- Gold members: Eligible for sharing at up to $15,000 in the 1st, additional $10,000 in the 2nd, additional $25,000 in the 3rd years, and NO more restrictions after 3rd year, subject to Guidelines

- A unit can be an adult, or all dependent children of an adult: One unit: 1 adult | Two units: 2 adults, or 1 adult + children | Three units: 2 adults + children

- Extended Coverage with Brothers’ Keeper Program: Annual fee $40 per year, plus $45 per quarter per unit

- For Bronze and Silver, amount is increased by $100,000 per year of renewal up to $1 million maximum. For Gold, it is unlimited.

- Maternity: Gold members only, and due date must be 300 days from start of membership

- DPC Membership: Shareable only on highest AHP plan of $12,000

Please refer to Liberty Healthshare’ website for full information.

- Most sharing requests have restrictions, and may require pre-approval. Enrollment requires completion of a health questionnaire.

- Pre-existing conditions: Eligible for sharing at up to $50,000 for in the 2nd and 3rd year of membership combined; No restrictions afterwards, subject to Guidelines

- Maternity: Conception has to be after joining

- Direct Primary Care (DPC) Membership often include office visits in the monthly membership fee at no additional cost.

- DPC Membership fees can be reimbursed at up to 75%, subject to change by Liberty.

Please refer to Solidarity Healthshare’ website for full information.

- Pre-existing conditions = Existed in 24 months prior, Cancer requiring care in 60 months prior, or Conditions requiring lifetime care

- No sharing in 1st year, max $25,000 for in the 2nd and 3rd year of membership; No restrictions afterwards, subject to Guidelines

Please refer to United Refuah Healthshare’ website for full information.

- Pre-existing conditions: No sharing in 1st year, max $25,000 for in the 2nd and 3rd year of membership; No restrictions afterwards, subject to Guidelines

- Pre-existing conditions also include a lifetime chronic condition or a condition that requires lifetime monitoring, even if asymptomatic at the time of enrollment.

Previous editions of this blog: